Table of contents

Introduction to Demand Deposits

What are Demand Deposits?

"Demand deposits are an integral part of any bank's balance sheet and must be managed properly to ensure stability."

- Amitabh Chaudhry, MD & CEO at Axis Bank (India)

Demand deposits are a type of banking account. They allow customers to withdraw their deposits immediately without advance notice or penalty.

Demand deposits are also known as "checking accounts." That's because they enable customers to write checks against the balance in the account.

The name "demand deposit" is derived from the fact that such accounts have no fixed maturity date. They can be withdrawn upon demand from the bank at any time with no loss of principal.

Demand deposits do not pay interest since withdrawals can happen anytime without pre-notification. Credit unions and some commercial banks offer these types of accounts. These are designed for individuals and businesses who use them for transactions like:

- Making purchases.

- Sending payments.

- Receiving salaries and wages into their checking accounts.

Demand deposits are almost always denominated in currency units (INR, USD, EUROS, etc.).

The money deposited into these belongs only to the depositor. It becomes property of the financial institution only when it is lent out or invested while remaining on record in said individual's checking account.

Moreover, although not a legal requirement, all international banks must maintain minimum reserve requirements set by each country's central bank to ensure liquidity even if there is an unexpected drain on official reserves due to sudden withdrawal requests made by customers under normal circumstances.

An Overview of Reasons Why Demand Deposits Are Considered Money

Demand deposits are viewed as money because they serve many purposes:

- Demand deposits are considered secure stores of wealth and provide customers with liquidity, which allows them to access their funds.

- Furthermore, demand deposits allow customers to make payments both domestically and internationally reliably and via online banking platforms or peer-to-peer payment apps.

- Additionally, due to its use in saving or investing, demand deposits support economic activities such as consumer spending or business investments.

- Finally, this form of money is backed by the central government's legal tender law providing it a guaranteed source of repayment if something goes wrong with the bank itself.

All these qualities combine, making demand deposit accounts an ideal currency for daily transactions while maintaining their value over time, regardless of price fluctuations in other asset markets such as stocks and bonds.

History and Development of Demand Deposits as Money in India

Demand deposits have been around for centuries, but the development of modern banking systems has made them an integral part of the global economy.

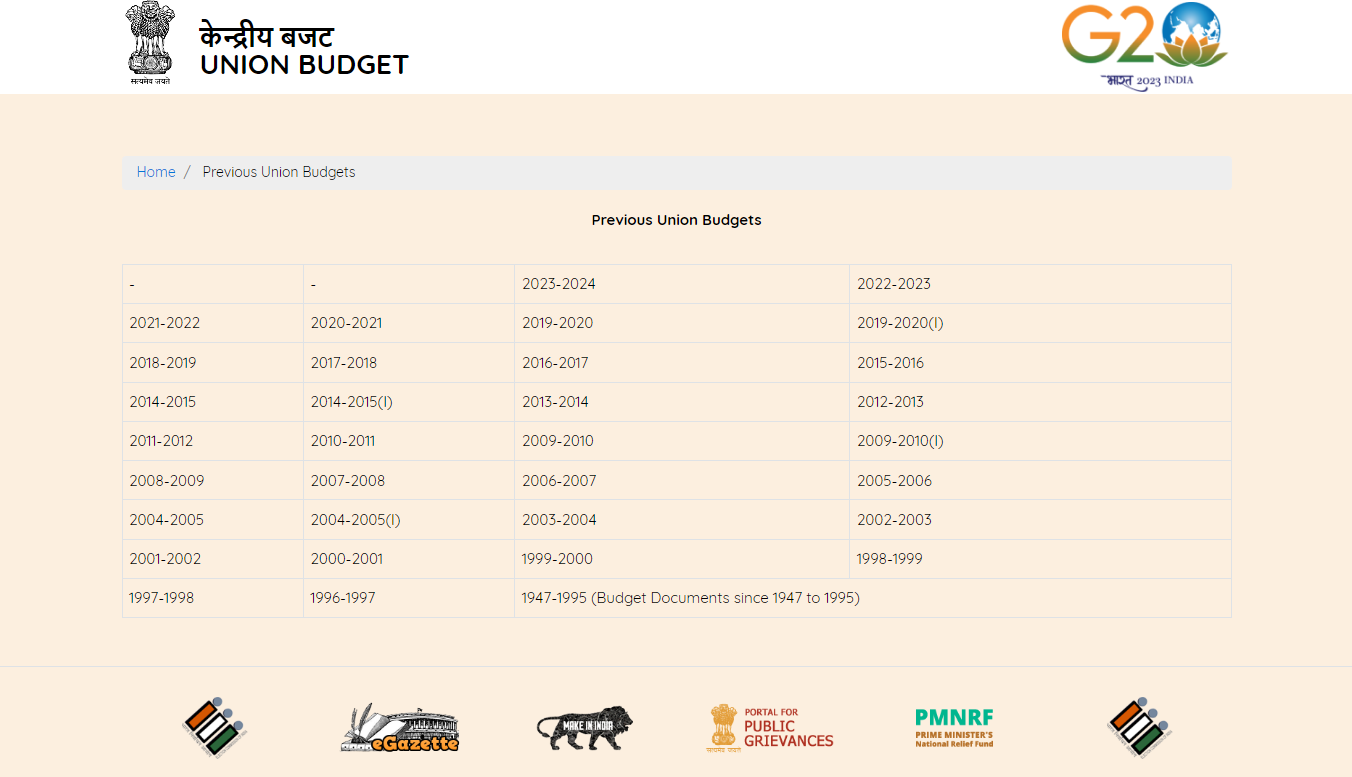

The history and development of demand deposits as money began in India during the early 19th century. The first bank to accept demand deposits was the Bank of Hindostan in 1806.

This opened up a new avenue for financing business ventures and reducing transaction costs associated with barter transactions. Soon after this, other banks, such as the Bank of Bengal (1809), Bank of Madras (1843), and Imperial Bank (1921), followed suit to become major players in India's banking system.

By the mid-20th century, demand deposits had become an important source of liquidity for Indian businesses and households. Banks started providing overdraft facilities on these accounts, which allowed customers to withdraw more than their deposit balance without incurring penalty fees or interest charges on shortfalls.

This gave customers added flexibility when making payments or investing funds deposited into their current accounts since they could access larger amounts than those present at any given time due to overdraft limits set by their bank's risk management policies.

During this period, India also witnessed tremendous growth in its networked ATMs. Which further expanded access to demand deposit services beyond traditional brick-and-mortar banking establishments. Thus giving people more control over how they manage their finances while allowing banks greater reach into remote rural areas previously unreached by conventional banking systems before then.

Today, India is one of the world's largest economies. Approximately 735 million people use digital wallets/payment apps linked to debit/credit cards issued from banks across the country. This shows how far we have come since our humble beginnings two centuries ago!

Demand deposits continue to serve as a crucial component within today's financial infrastructure, offering individuals easy access to their hard-earned cash anywhere at a minimal cost relative to other payment methods available right now!

Benefits of Demand Deposits as a Form of Money.

Demand deposits are a form of money that benefits individuals, businesses, and other organizations.

1. Liquidity

The most obvious benefit is the liquidity it offers. Demand deposits allow immediate access to funds, making them an ideal medium for short-term transactions or payments.

Individuals can withdraw cash from their accounts when necessary, while businesses and organizations can make quick payments with minimal effort. This makes demand deposits much more convenient than other forms of money, such as coins and notes, which may require time-consuming trips to the bank or post office before they can be accessed.

2. Safety

"When you deposit money in the bank, you get it back if you need it right away; that’s why they call them demand deposits."

– Mark Twain

Another major advantage is safety. State and central laws protect money in demand deposit accounts, ensuring security against theft or fraud.

Banks also have safeguards, such as encryption technology and secure servers, to protect customer information, so users know their money is always safe.

Also, depositors enjoy limited liability should something go wrong with their accounts. They won't lose any more than originally deposited if an issue occurs.

3. Flexibility

Finally, demand deposits provide flexibility when accessing funds because there are no restrictions on how often or where withdrawals can be made, unlike other financial products like certificates of deposit (CDs).

Additionally, banks offer different interest rates on checking accounts depending on the amount maintained.

Hence, customers can earn returns based on how much money they decide to keep in their account over time.

4. Peace of Mind

In summary, demand deposits offer convenience, flexibility, and the peace of mind of knowing that your funds are secure due to strong legal protections by state and central governments, plus more safeguards implemented by banks.

For these reasons alone, it's easy to see why this type of money remains popular among individuals, businesses, and other organizations!

Advantages to Financial Institutions When Establishing Accounts in the Form of Demand Deposits.

Demand deposits are one of the most popular and used accounts offered by financial institutions in India. They offer several advantages to customers and banks, making them an attractive option. Advantages for Financial Institutions:

1. Increased Revenue Streams

By offering demand deposit accounts, financial institutions can increase their revenue streams through interest earned on the account balances held and fees charged for various services related to the account, such as overdraft protection or online banking access.

2. Expansion Opportunities

Demand deposit accounts provide a low-risk way for financial institutions to expand into new markets and customer segments without having to incur significant upfront costs associated with setting up more traditional savings or loan products.

This provides a great opportunity for growth in areas where other products may not be workable due to lower levels of risk tolerance or lack of resources available from customers.

3. Improved Liquidity Management

Demand deposits provide a reliable source of liquidity which helps financial institutions manage their balance sheets more and reduces exposure to market volatility when seeking short-term financing options or investment opportunities.

This is especially true when other forms of capital are scarce due to tight credit conditions or economic downturns.

4. Low-Cost Base

Since demand deposit accounts require very little setup cost, they provide an efficient way for financial institutions to increase their customer base without incurring significant overhead expenses such as branch infrastructure, etc.

The cost efficiency makes it easier for banks and other lenders to enjoy higher net profit margins while offering competitive rates on savings accounts, home loans, personal loans, etc.

5. Enhanced Security

With recent advances in technology, demand deposit account holders can now rest assured that their money is safe with secure authentication processes employed by banks, such as biometric verification, two-factor authentication, and encryption standards.

The Role That Payment Services Play In Connecting Financial Institutions with Customers Through Electronic Transactions Using Demands Deposit Accounts.

Payment services are important in connecting financial institutions with customers through electronic transactions using demand deposit accounts (DDAs) in India.

The payment services act as a bridge between the customer and their respective bank, allowing them to transfer money or pay for goods or services. DDAs ease these payments and provide a secure way for customers to access funds while ensuring that all transactions are stored.

In India, there are several types of payment services available such as mobile banking, internet banking, Real Time Gross Settlement systems (RTGS), National Electronic Funds Transfer (NEFT), debit cards, and Unified Payments Interface (UPI). These allow customers to make online payments without visiting the bank branch.

Mobile banking is one of India's most popular payment service options since it allows users to transfer money from one account to another using their mobile phones or tablets. This method also eliminates the need for carrying physical cash around when making payments and ensures that all transfers are secure with two-factor authentication methods such as OTPs and biometric login credentials like fingerprint scans.

Internet banking can also be used by customers who want a more traditional approach when transferring funds or paying bills online. This option gives people access to their account information 24/7, even if they're not near a computer or phone at the time of the transaction - this makes it much easier for busy professionals who may not have time during working hours but still require quick fund transfers on short notice occasions like unexpected medical costs etc.

Additionally, banks offer convenient features such as bill payments which can be done from the user's digital wallet within minutes, thus eliminating tedious paperwork associated with manual bill submission & processing by post office staff!

All other modes, including RTGS/ NEFT/ UPI, help complete real-time interbank transfers enabling immediate payments without any delays due deposit verification process involved in cheque-related deposits!

Customers also enjoy higher security standards because each transaction is authenticated via a unique PIN code every time it's made, so fraudulent activities become much less likely than ever! With all these advantages combined, we can see why Payment Services are becoming increasingly popular amongst individuals & businesses alike!

Conclusion

In conclusion, demand deposits are an essential part of the modern financial system and serve as a form of money. The history and development of demand deposits have allowed them to become used by customers to store their funds with banks and make payments.

Demand deposit accounts provide several benefits, such as higher interest rates than cash, greater liquidity, increased safety from theft or loss, and convenience for electronic transactions through payment services like debit cards, credit transfers, etc.

Finally, they offer an advantage for financial institutions when establishing accounts in the form of demand deposits. As such, this form of money continues to play a vital role in today's economy.