Table of contents

The decision to keep mutual funds in a Demat account or a statement of account (SOA) requires a careful consideration of several variables. While a Demat account is generally linked with keeping shares, the option to hold mutual fund units in a dematerialized form has both advantages and disadvantages.

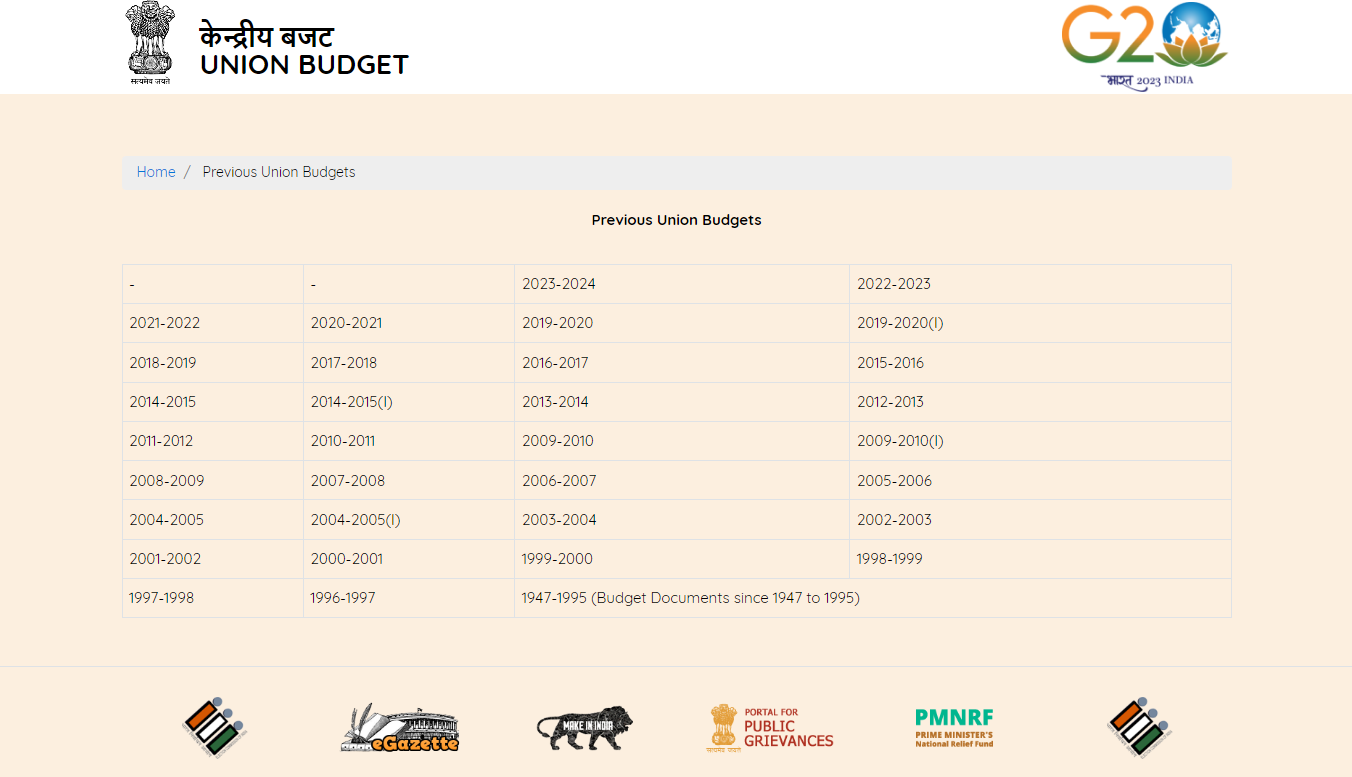

Source: 1

Source: 2

What is a Demat Account?

A Demat account, short for "Dematerialized Account," is an electronic account that contains digital financial securities. It enables investors to buy, sell, and transfer securities like stocks, bonds, and mutual fund units electronically, eliminating the need for paper certificates.

What is a SOA?

SOA is an abbreviation that stands for "Statement of Account." An SOA is a document supplied to mutual fund investors by the asset management company (AMC) or the registrar and transfer agency (RTA).

It describes an investor's mutual fund holdings in detail, including the number of units held, transaction history, NAV (Net Asset Value), and other pertinent information. An SOA, unlike a Demat account, is a statement that shows the investor's mutual fund portfolio in real-time.

Understanding Mutual Funds Holding Format

Mutual fund investors often have the option of holding units in an SOA or opting for the demat format. In both circumstances, the units are digitized, removing the requirement for paper certificates.

The Benefits of Holding Mutual Funds in Demat

- ETF Investments: Demat accounts are beneficial for investors who frequently trade exchange-traded funds (ETFs). ETFs, which are only traded on stock exchanges, are seamlessly perfect with demat accounts.

- Simplified Nomination: In the tragic case of the unit holder's death, the transmission of units to the nominee becomes easier with demat holdings. Approaching the depository with a transmission request is the first step in the procedure and the rest is also simple.

- Consolidated Portfolio View: Having mutual fund units in demat form allows you to have a consolidated picture of your various financial investments. Stocks, gold bonds, ETFs, NCDs, and mutual fund units can all be tracked in one spot by investors.

- Streamlined Transfer: With demat holdings, the transfer of units to nominees or legal heirs becomes more efficient, removing the need for documentation with each particular asset management company (AMC).

The drawbacks of Holding Mutual Funds in Demat:

- Limitations on STP and SWP: Demat accounts restrict the use of systematic transfer plans (STP) and systematic withdrawal plans (SWP). While systematic investment plans (SIP) are permitted, these restrictions may influence the financial planning methods of certain investors.

- Annual Maintenance Fees: Demat accounts have associated costs, such as annual maintenance fees ranging from Rs 300 to Rs 700. Furthermore, transaction fees of about 0.05% of every transaction add to the financial issues.

- Single Account Holder: Demat accounts, unlike SOA, do not enable numerous account holders for a specific investment. This restriction may present difficulties for those who seek to disperse investments among many successors.

- Liquid Fund Processing Time: Purchase and redemption of liquid funds in demat form may experience delays due to processing at the end of the depository participant. Holding liquid funds directly with AMCs, on the other hand, enables same-day transfers.

While demat accounts provide a consolidated view and efficient nominee management, SOA has more advantages. Investors in SOA mutual funds can transact through a variety of channels, including online platforms, investor care centres, and registrar and transfer agents, all without paying yearly fees.

SOA is an appealing alternative for many investors because of the flexibility of STP and SWP, as well as the absence of annual maintenance fees. The ability to name separate nominees for different folios offers an extra layer of convenience.

Moreover, the form of holding has a heavy effect on the procedural complexities in circumstances of death or transmission. SOA allows for folio-level customization, whereas demat holdings involve a simple transfer to the nominee's demat account.

Choosing the Most Appropriate Holding Format

Based on their investing objectives and preferences, investors must carefully assess the benefits and downsides of each holding type. Trading frequency, the necessity for customization, and the significance of nominee-related issues all play a role in the decision.

The option of whether to hold mutual funds in demat or SOA format requires careful study. A personalized approach that matches individual financial goals and preferences becomes critical to a successful investing plan as investors negotiate the subtleties of these holding forms.