Table of contents

Saving money is something that everyone needs to do in India. With rising living costs and increasing prices, saving money is becoming more important than ever. There are many ways to save money in India.

So, from now on, I promise to save money and keep my spending under control. Tomorrow arrives, and the first thing I'd do is buy a coffee, and I'd conclude the day without saving anything but buying a vase that wasn't even necessary. Relatable?

If so, then join us for a fun but informative ride filled with simple ways to learn how to save money in India. As in our daily lives of nonstop working and survival, we are unaware of many random minor expenses that significantly impact our spending.

We will explain how to save money in the simplest way possible and eliminate unnecessary expenses. But first, let's look at why we don't save money.

Have you ever thought about this? Alisha, why aren't you saving money? You might be like, "I tried to do it, but things just happened," which is understandable given that not everyone has read this article to assist them in comprehending the fundamentals of saving money.

But now that you're here, we're confident that your tomorrow will arrive tomorrow!

Let us start with an example to explain why saving money in India is difficult. If you have two options: one is to take INR 1 lakh now, and the other is to take INR 1.10 lakhs after a month.

I'm sure many of you would choose the quick option because an instant gain of 10,000 INR isn't enough to sway your opinion over a month of wait. Nevertheless, again assume you can receive INR 1.10 lakhs in one year and INR 1 lakh in 11 months.

It's only one month, and you're getting ten thousand extra for an extra month of waiting, so why not INR 1.10 lakhs? The cost and time by ratio are the same when comparing the two scenarios, but the options chosen differ.

Yet, because the money in the first example was instant, the majority would choose it because waiting a month for a 10k add-on is not a better alternative for instant INR 1lakhs.

In the second example, you had to wait for almost a year because 11 months isn't much different than 12 months, and since you're getting an extra $10,000, it's clear that it's the majority choice.

Everyone enjoys quick gratification because it gives us a feeling of achievement, and we humans are always looking for gratification and pleasure, and it's just you and me here, so be true to yourself and accept your practical limits (haha).

We were not designed to make long-term judgments (we, as in all of us struggling to save money in India). Now, let's look at another example to see how the notion works.

If you were given a choice between an apple and Cadbury as a snack, the vast majority of you would undoubtedly choose the apple if given time to think.

The reasons are simple: you are aware of the circumstance and wisely provide a solution because it is a predictive value that is not present or may not occur, so why not choose the healthier one?

Yet, if both options were physically present and you were abruptly asked to choose between apple and Cadbury, I'm sure you'd choose Cadbury, as most people would.

But, if you dislike Cadbury, you can replace it with another product of your choice rather than complaining.

Yet the point of these instances was to help you comprehend the concept of "present bias." It is the tendency to overvalue current benefits at the expense of long-term objectives and benefits, no matter how sweet the long-term reward is.

We're all aware that we need to start saving money, but why doesn't tomorrow come (sobbing in the corner)? We don't save money because of Immediate gratification and Present Bias, which cause us to focus on the present rather than the future.

This makes saving for the future a tough notion, and because we have the traditional mentality of "kal kisne dekha hai," savings become a non-essential aspect, and we attempt to live in the present to the fullest.

But, just because we say something does not mean it needs to be related; rather, it is the average mentality that we have addressed. You may disagree, but you must understand that you should save at least 20% of your monthly income.

The more money you save, the better. For that to happen, you must invest appropriately in commodities with various possibilities where you can automatically save more money on small features that actually consume a big part of your budget.

Let us now proceed to study how to save money using the most effective tips and tricks. These methods and suggestions are intended for anyone who is struggling to save money, and we have gone through every detail possible for you to understand how to save money.

Save Money India, let's go!

This article will look at 43 tips to help you save money while living in India.

1. Make a budget

Creating a budget is one of the most important steps in saving money. A budget allows you to identify areas where you can save and allocate funds towards long-term goals, such as retirement or buying a house. Here are some tips for making an effective budget:

💰 Start with your income

The first step in creating a monthly budget is to determine how much money you have coming in each month and set aside any savings that will go into a separate account (you may also want to put this money away first).

⏱ Track Your Spending

Make sure to track every expense, no matter how small. This will help give you an idea of what’s going out of your pocket each month and make it easier for you to create realistic spending limits. 📝

🎯 Set Clear Goals

Once you know what's coming in and going out each month, decide on achievable goals within the timeframe selected. These should include short-term objectives (eating lunch at home instead of eating outside) and longer-term ones (allocating funds for other investments or paying off debts faster). 🎯

🕵️♀️ Monitor Regularly

Monitoring regularly helps ensure that your plan remains on track by tracking any changes which could affect it significantly. You should review expenses weekly/monthly depending on the duration chosen so that quick adjustments can be made if necessary before too much time has elapsed! 🔍

2. Cut down on eating out

Eating out is often one of the biggest expenses for people in India. Apps like Zomato & Swiggy can create a temptation to order food with a click, but you should cook at home. Saving money by cutting down on eating out can be a great way to boost your budget. There are plenty of ways to cut back and still enjoy restaurant-style meals at home! Here are some tips:

📆 Plan Ahead

When planning your weekly meals, think about what kind of groceries you need to make more homemade dishes instead of going out for dinner. Try making delicious soups, salads, sandwiches, etc., that require minimal effort but provide maximum flavor. 🍴🥗

🥡 Repurpose Leftovers

Get creative with the leftovers in your fridge! A piece of grilled chicken or leftover steak makes a perfect main course when paired with roasted veggies, brown rice, or quinoa - nearly as good as takeout but much cheaper! 😋👏

🍲 Batch Cook

Instead of always cooking from scratch each night, save time (and energy!) by batch cooking one or two meals ahead for the week – lasagne freezes well, so why not prepare it in advance? This could also help reduce food waste too, bonus points all around! 🤩😃

🍽 Eat Out Less Often

Restaurants generally have higher prices than you’d pay if you cooked those same ingredients at home. If eating out is an important part of socializing for yourself, consider decreasing the number of times per month rather than eliminating it - make sure to set yourself limits so you don’t overspend 👍✅

With these simple tips, I hope that now saving money will seem easier and less daunting. Bon Appétit ⭐

3. Shop in bulk

Shopping in bulk is one of the most effective ways to save money on your monthly grocery shopping. It can help you stretch your budget and get more value for money by buying larger quantities of food at a lower cost and reducing waste. Here’s how you can start saving money when you shop in bulk:

🛍 Shop around

Compare prices between online and offline stores. Do some research before making any purchases always to get the best deals! 🤑🤩

🍂 Buy seasonally

Fruits, vegetables, and other seasonal produce often come at discounted rates during certain times of the year due to their abundance in those seasons – make sure to take advantage of this! 🍅👐🥬

🤑 Check for discounts/offers

Many supermarkets offer discounts or loyalty program rewards when purchasing items from them - it pays to stay alert about these offers to maximize savings! 🛒😎

👥 Join wholesale clubs

There are plenty of wholesalers across India, such as Big Bazaar and Reliance Fresh, who provide great savings opportunities with huge discounts if one opts for their membership schemes, cheaper than buying items every day separately from regular grocery stores. 🧾✨

💪 Bulk-up nonperishable products

Pantry staples like grains & pulses have long shelf lives, which means they are perfect candidates to buy in large quantities – stocking up will likely work out much cheaper over time rather than purchasing smaller amounts regularly ⚡

4. Shop for cheaper alternatives

Saving money is a way of life; shopping for better alternatives can be done. Whether you're stocking up on groceries or purchasing an item online, here are some tips to help you save money while getting the most out of your purchase:

🔎 Look into generic brands

Opting for off-brand items in supermarkets can offer comparable quality at a fraction of the cost. This could range from frozen foods to personal care products.

🤑

💰 Take advantage of sales and discounts

Many stores run special offers throughout the year that allow customers to buy items at lower prices than usual - these include seasonal clearances and promotional events too! Stick to reputable deal sites such as Groupon India or Amazon’s Deal Of The Day page, so you don't get scammed with fake discounts. 🛍️

🤝 Buy Used Items When Possible.

Buying secondhand does not necessarily mean poor quality – instead, look for gently used clothing, furniture pieces, and electronics, which will come with greatly reduced price tags! It's also helpful if one wants something specific but is no longer in production – sites like eBay India or OLX often have rare finds available without breaking your bank balance 👩👧👦

🛍 Shop Around Before Making Big Purchases

Big ticket purchases like cars require research time before committing financially; check different dealerships as well as online services like CarDekho (India), which compares car models based on reviews and specifications ⚡️

With smart shopping decisions, saving money doesn't seem so daunting! Be sure to follow these tips next time you shop around 😉

5. Use cash instead of credit cards

Credit cards can be a great way to manage your finances, but they can also lead to overspending. 🤑 It’s no secret that using cash instead of credit cards can help you save money. Here are some benefits of paying with cash rather than credit:

✅ Quickly see how much you have available

When we use physical notes and coins, it's easier to keep track of our spending. You will always know exactly what amount is left in your wallet or purse immediately after making a purchase.

✅ Avoid unnecessary purchases

Studies show that people tend to spend more when they pay by card as opposed to cash because there is not the same cognitive pain from parting with hard-earned money when compared with financial loss through plastic transactions on a statement at a later date; By paying in cash, one might be able to resist temptations better and make logical decisions about their finances.

✅ Facilitate budgeting

Cash provides greater control over expenses since the exact amounts spent each day are visible upfront without having to wait around until bills come due at the end of the month, like those associated with using credit cards which could lead to debt accumulation if unchecked regularly.

🇮🇳 For Indians specifically, there are other reasons why opting for the hard currency may be beneficial, such as avoiding ATM fees (especially outside bank networks) and enjoying discounts/benefits given by participating local merchants who offer incentives only when customers choose traditional payment methods instead digital ones like Paytm etcetera! 😊

6. Use coupons and discounts

Coupons and discounts are great ways to save money on everyday purchases. Look for coupons online or in newspapers, or ask retailers if they offer discounts or specials. CouponDunia is a good site to search for Indian deals and coupons. 💰Saving money using cash coupons and discounts is a great way to stretch those rupees further. Here are some tips on how you can make the most of your budget:

🤔 Compare prices

Before you shop, take some time to compare prices online or at local stores to get the best deal possible.

💸 Use cashback apps/websites

Apps like MobiKwik, Cashkaro, and MagicPin offer attractive discounts when users load money into their respective wallets via UPI payments or debit/credit card transactions. They also provide additional discount codes, which can be used for purchases from select merchants.

🎅 Look out for festive offers

Diwali, Holi, Durga Puja, etc., are times when many e-commerce websites such as Amazon & Flipkart come up with promotional deals where customers can avail hefty discounts on clothing, electronics, and other products by applying coupon codes at the checkout page.

7. Buy second-hand goods

Making smart shopping decisions is the key to spending less and saving more. There are many advantages of purchasing second-hand goods over brand-new ones, such as cost savings and environmental friendliness. Here's how you can save money by buying second-hand:

➡️ Shop at Thrift Stores or Second Hand Shops

These stores often have a wide variety of items, including clothing, furniture, toys, tools, etc., at discounted prices compared to regular shops. You can find great deals on quality products if you look carefully!

➡️ Buy from Online Platforms & Apps

Sites like OLX India offer pre-owned items in all categories with varying discounts. With filter options available for product condition and price range, it makes selecting what’s right for your budget easy!

➡️ Attend Garage Sales

This is an ideal way to find lightly used goods at economical rates from individuals who no longer need them but cannot afford to donate them away without any returns. You have to search in the nearby area or ask friends about upcoming garage sales near you!

➡️ Exchange Old Stuff with Friends & Family Members

We often hoard things we don't use anymore but still clutter up our homes - these are perfect candidates for exchanging instead of throwing away or gifting someone else outrightly free. Try asking people around to see if they're interested in trading something they own, which would benefit both parties involved while being pocket-friendly.

8. Take public transportation

Public transportation is not just an eco-friendly alternative to personal cars and cabs; it can also help you save a ton of money in the long run! Here are some ways that Indian citizens can use public transit to their financial advantage:

🚌 Take the bus or train instead of booking a cab

Traveling on buses and trains is much cheaper than taxis in most major cities, such as New Delhi, Mumbai, Bengaluru, and Chennai. It will be more affordable and quicker as they often have dedicated lanes with less traffic congestion.

💳 Invest in monthly passes for regular commuters

Instead of buying individual tickets each time you travel from one destination to another, look into monthly passes, which offer discounted rates compared to single journey costs. This would work great if you’re attending college/university every day or regularly going to the office on weekdays since the overall cost is cheaper than buying individual tickets each time 🤑 .

🚲 Look into bike-sharing schemes in your area

Bike-sharing schemes such as Yulu Bikes (Mumbai), Rapido bikes (Delhi), and Zoomcar pedl (Bengaluru). You may find these even more economical than other public transport - plus its great exercise too! ⚡️

Overall, investing your money wisely when it comes to modes of transport could end up saving you quite a substantial amount over time – so make sure to weigh all options before deciding what best fits your needs 😉

9. Reduce energy costs

With increasing energy costs, saving money is becoming harder and harder. However, there are many ways that we can reduce our energy usage and save some cash in the process! Here are some tips on how to reduce your energy bill:

➡️ Turn off lights when not in use

It may seem simple, but this small action alone can go a long way toward saving you money on your electricity bill.

➡️ Invest in LED bulbs for light fixtures

Instead of traditional incandescent or fluorescent bulbs – they consume much less electricity than their counterparts and last longer too!

➡️ Unplug appliances like TVs & chargers

Unplug when not in use since these devices still draw power even if no one’s using them.

➡️ Close all doors and windows tightly

Make sure that all doors & windows close tightly so that cool air doesn’t escape from inside the house during summer months – keeping cool air trapped helps maintain lower temperatures indoors, reducing AC usage (especially important if you're living in an area with hot summer weather). 🥵

➡️ Use ceiling fans instead of AC

Use ceiling fans instead of air conditioners whenever possible; they circulate cooler air without consuming as much electricity as AC units. 🌬

➡️ Utilize natural sunlight

Utilize sunlight wherever possible by opening curtains/blinds while at home during daytime hours - this reduces reliance on artificial lighting sources, which incur higher electricity bills over time. ☀

Hopefully, these tips will help you cut down on expensive energy costs & put more money back into your pocket! ☺

10. Buy generic products

Saving money by buying generic products is a great way to stretch your budget. Here are some effective tips for doing it:

🔎 Identify the Brand Names

Knowing what brand names you want can help when selecting generic items at the store. Look up prices online or in ads and note which brands offer good value.

🛍 Compare Prices Before Shopping

It's important to compare prices between different stores before shopping — this will help you get the best possible deal on generics and other goods. 🤩

🗓 Check Expiration Dates

Make sure that any product you buy hasn't expired! This could cause health problems down the road, so check expiration dates carefully before purchasing anything generic or otherwise. 😷

🤔 Ask About Discounts & Coupons

Most retailers provide discounts if more than one item is purchased together - don’t hesitate to ask for these deals! Many companies also offer coupons for certain products; keep an eye out for them! 🔍

Following these tips can help make buying generics less intimidating—and potentially save quite a bit of cash in India along the way! 👍

11. Don’t buy things you don’t need

Impulse buying is one of the easiest ways to throw away your hard-earned money. Try not to buy things you don’t need and only buy what you need and use.

Nowadays, it is more important than ever to practice mindful spending to save money. Here are a few tips on how you can do this in India:

💰 Create a budget

Start by writing down your income and expenses, so you know exactly how much money comes into your account each month and where it goes out. This will help you track what’s going out of the budget unnecessarily and make changes as needed.

📊 Prioritize savings

Before anything else, set aside some monthly amounts for saving or investing for future needs like medical emergencies, retirement funds, etc. Make sure that these savings come before any other expenditure while creating your monthly budget.

🛍 Be mindful when shopping

Try not to buy things that aren't essentials, such as clothes, electronics, or even food items, if they won't be consumed immediately! Also, remember to compare prices between different stores/websites while shopping online, so you get better deals while still getting good quality products, too 🙂

🔎 Seek alternative solutions

Instead of buying something new, look at alternatives such as swapping with family & friends or renting items through sharing platforms instead of purchasing them outright (books/clothes, etc.). All these little steps can add up over time resulting in significant savings! ☺️

12. Create an emergency fund

Creating an emergency fund is a great way to save money in the long run. It gives you peace of mind knowing that if something unexpected happens, such as job loss or medical expenses, you have financial stability and security. Here are some tips on how to create an emergency fund:

⭐ Set realistic goals

Start by setting specific savings goals for yourself; think about how much you would like to start with and what kind of timeline works for your lifestyle and budget.

⭐ Automate your savings

You can set up monthly bank transfers from checking accounts into dedicated savings account so that each month, part of your paycheck goes directly into this "rainy day" account without relying solely upon willpower.

⭐ Track spending

Monitor where all your income is going so that you identify areas where adjustments may be necessary to free up funds for saving more money for the future.

⭐ Get creative

Try selling items online or find ways to generate extra income through side gigs ♀️- perhaps tutoring students after school hours, providing pet-sitting services, etc.

⭐ Utilize tax benefits

Take advantage of government schemes such as PPF (Public Provident Fund) and Sukanya Samriddhi Yojana, which offer high long-term investment returns with substantial tax benefits 🤑 .

These small actions will help you get started building an emergency fund quickly! 💪

13. Invest wisely

Saving money is an essential part of financial planning. Investing wisely can help you build wealth while reducing the risks and costs associated with investing foolishly. Here are some tips on how to save money by investing wisely:

💸 Start Early

The earlier you start investing, the more potential for growing your investments will have in the long run due to compounding returns. Don’t wait until it's too late – take advantage of compound interest now!

🤝 Diversify Your Investments

It’s important to diversify your portfolio across different asset classes, such as stocks, bonds, or real estate, depending on your risk appetite and liquidity needs. Doing so helps reduce losses from any investment class that may underperform at a given time.

🔍 Research Well Before Investing

Educating yourself about various instruments before making any decision is advisable when choosing which instrument and where and how a small amount should be invested. Do a complete checkup of fund performance ratings and other factors like management style before selecting a product/scheme.

☠️ Understand Fees & Expenses Associated With Investment Instruments

Always remember that fees and expenses are involved in every type of investment, whether it's mutual funds or direct equity market trading. One must clearly understand all charges involved, even if they seem small; these add up over time, thus erasing potential gains.

📈 Buy Low & Sell High Using Dollar Cost Averaging Technique

Try practicing the dollar cost averaging technique where buying fixed amounts periodically (e.g., once a month) rather than timing markets gives better results, i.e., buy low during bearish conditions, then sell high during a bullish trend. This way, one could earn decent profits consistently.

📉 Tax Efficient Products For Long-Term Gains

In India, certain tax-efficient products like ELSS (Equity Linked Saving Scheme), PPF (Public Provident Fund), etc., offer great return opportunities, especially for long-term income flow.

14. Use price comparison websites

We all know that life can be expensive, and most constantly look for ways to save money. One great way to get the best deals on items you need is by using price comparison websites. 🤑

Here’s a look at how you can use these sites to find the best prices online:

🔍 Check Multiple Vendors

Price comparison websites allow you to compare prices from multiple vendors in one place, so it's easy and convenient. 😊 You'll quickly see who has the lowest price or special offers available and decide which vendor to buy from.

🤑 Get Coupon Codes

Coupon codes often appear around shopping holidays like Black Friday or Cyber Monday, making it easier for buyers who want even bigger savings opportunities! 👍🏼 So be sure to check out the coupons section before finalizing your purchase!

💰 Look Out For Cashback Offers

Many Indian-specific companies, such as Paytm, offer cashback discounts through their payment services when customers shop with certain retailers via their platform. 🤩 So keep an eye out for any potential cashback rewards when browsing different retailers' websites!

📝 Read Reviews Before Making A Purchase

Price comparison sites often have product reviews where users rate different items they purchased earlier so that other shoppers can also learn more about what they're buying beforehand. 📖 It helps give more insight into what products would provide better value compared to others available on these platforms

15. Automate savings

Saving money can be challenging, but it doesn't have to be. Automating your savings is one of the best ways to guarantee that you save more and stay on track with your financial goals. Here's how:

💰 Set up automatic transfers

Most Indian banks offer automated funds transfer services so that you can set aside part of each paycheck or salary into a dedicated savings account. This way, you never even see the money in your checking account—it goes straight into savings!

☝️ Make use of rewards programs

Many banks in India now offer loyalty reward points for customers who make regular deposits into their accounts. These points can later be redeemed towards purchases made online or at partner stores when used wisely over time could add up significantly, helping build an emergency fund for rainy days.

📉 Invest regularly through SIPs

Mutual Fund investments via Systematic Investment Plans (SIP) are another great way to automate saving plans by setting-up periodic investments rather than making lump sum payments. It helps mitigate market volatility and allows easy tracking & viewing of contributions instantly from one’s investment portfolio without having too much effort put in every month.

16. Use rewards programs

Many retailers offer rewards programs that allow customers to earn points when they make purchases. These points can then be used for discounts or free items, allowing you to save money on future purchases at the store. Here are some tips on how to use rewards programs to save money in India:

💰 Join Cashback Sites & Rewards Programs

Look for online cash-back sites and loyalty programs offering substantial discounts or vouchers when purchasing at partner websites/retailers. Some examples include Amazon Pay Balance, Flipkart Plus Coins, FoodPanda Panda Points, etc.

🤝 Sign Up For Store Loyalty Cards

Signing up for store loyalty cards not only gets you exclusive offers and promotions on your favorite brands but also provides additional benefits, such as freebies and discount coupons which could help you save even more money! Examples include Big Bazaar Happy Card, Croma Care VIP Membership Club, etc.

😊 Take Advantage Of Credit Card Offers & Discounts

Many credit card companies provide great rewards like cash back and points, which allow customers to save when shopping via their affiliated partners or financial institutions like banks. Check out all the available deals before spending to maximize your savings potential from this route too!

🎁 Make Use Of Special Promotions/Events

Take advantage of seasonal sales events such as the Diwali Shopping Fair, Holi Sale, Christmas Sale, etc., where stores offer promotional discounts, including BOGO (Buy One Get One Free) offers, which will help cut down costs significantly if used wisely. So keep an eye out for these opportunities when shopping in physical stores or online outlets!

17. Sell unwanted items

Selling unwanted items can be a great way to make extra cash and clear out clutter from your home simultaneously. Consider selling old clothes, furniture, electronics, and other items you no longer need or use via online marketplaces like OLX India. Here are some tips on how you can save money by selling off those old and unused items:

✅ Buy Low & Sell High

When shopping for secondhand goods online or offline, look for deals that offer discounts or discount codes so that you don't have to pay full price. Once purchased, resell the items at higher prices to make a profit.

✅ Fix Up & Flip

If you're handy with tools and know-how, why not try restoring used furniture and appliances? With just a little elbow grease (and sometimes money), these pieces can often fetch much more than originally paid.

✅ Unlock Your Home's Hidden Savings Potential

Got extra space lying around? Why not rent out your spare bedroom or garage in return for additional income? There are plenty of apps available now that allow homeowners to do exactly this 😎👍

18. Get cashback on credit cards

Many credit card companies offer cashback rewards for purchases at certain retailers. Or even for purchases such as gas or groceries throughout the year. Take advantage of these rewards programs by using your credit card when making certain types of purchases so that you can get some extra cashback in your pocket.

✅ Start Using Cashback Credit Cards

A cashback credit card is a great way to save money while spending. You can get up to 5% or even more in cash back when you use them for everyday purchases like grocery shopping, fuel, and online payments. With careful planning and wise use of your cards, you can easily earn hundreds of rupees each month without any extra effort.

💰 Use Cred App To Increase Your Earnings

The new buzzword among savvy Indian consumers is the “Cred app,” which helps users get additional savings by earning points with each transaction they make through its network partner banks like SBI Bank and ICICI Bank. By collecting these reward points over time and then redeeming them at select merchant outlets associated with the Cred app, one can maximize his/her earnings substantially, making it an excellent tool for saving money on regular day-to-day expenses 🤑

🔄 Do Not Forget About Return Policy

In case something goes wrong with a product purchased from the retailer, don't forget the return policy offered by most major eCommerce store allow us to send the item back within the shortest possible duration & get the refunded amount credited directly into the account further; this saved amount should also be considered account while calculating our net monthly gains through above tips 😁.

19. Negotiate lower prices

Are you looking for ways to stretch your money? One of the most effective methods is learning how to negotiate lower prices. Whether it’s buying groceries, electronics, or even services – negotiating with vendors and service providers can be a great way to save money in India! Here are some tips on how you can get started:

✔️ Take your time & do research

Before making any purchases (online or offline), ensure you have done as much market research as possible. This will allow you to pick up pricing specifics and provide useful ammo when bargaining with shopkeepers/vendors.

✔️ Be bold but respectful

It may seem intimidating at first, but don't be afraid of pushing hard while shopping around different stores/marketplaces; after all, they depend on sales just like us! Just remember not to go overboard and always stay respectful towards the other party throughout the negotiation process.

🛍 Visit street markets

Markets like Sarojini Nagar in Delhi are filled with shops selling items at highly discounted rates – so make sure you visit them whenever you're out shopping for bargain deals! Plus, keep an eye out for discounts being offered by vendors during festivals such as Diwali, etc., which could help sweeten already existing deals even more 😉

ⓘ Be creative & think outside-the-box

Many sellers offer attractive discounts if customers buy multiple products from their store/website. Please take advantage of this by bundling together unrelated items that fit within the budget; chances are they'd be more willing than one big purchase alone ☺

🤝 Use “payment method” tricks

If a vendor isn't budging despite your best efforts… Try offering a payment solution through a debit card instead of cash. Most times, these transactions attract additional discounts due to soft swiping fees waived off in favor of customers 😊.

With just a few small changes here and there, negotiating lower prices can lead to significant savings over time ⏳ So next time when out grabbing supplies, don't forget to use what you've learned today to push down those rates!! Good luck haggling, everyone :)

20. Invest in energy-efficient appliances

Investing in energy-efficient appliances can be a great way to reduce costs and help the environment. Here are some tips on saving money with energy-efficient appliances:

✅ Look for Energy Star-rated products when shopping

These items use less energy, which means fewer monthly bills and more savings over time. 👍🏻

🤑 Consider appliance upgrades

Upgrading old models of refrigerators, washing machines, dryers, or air conditioners to newer ones that have better efficiency ratings could save you hundreds of dollars annually in electricity costs.

💦 Use cold water whenever possible

Hot water uses up much more electricity than its colder counterpart, so try handwashing clothes instead of using your washing machine’s hot cycle option if you want to reduce your power bill every month significantly!

☁️ Buy smart/app-enabled devices

Smart or app-enabled devices allow users to remotely control their appliances at home from anywhere, which also helps them save by being able to monitor usage times and regulate temperatures accordingly while they're out at work or running errands etc.

😎 Look into local offers & discounts

Don't forget about looking into local solar installation companies, who offer special seasonal discounts plus government subsidized loans as well as state-sponsored rebates on energy-efficient purchases like LED lights (like Syska), cool roofs & improved insulation systems, etc...to encourage customers to invest in green energies and reducing their carbon footprint!

21. Use online banking services

Saving money via online banking can be a great way to improve your financial situation. Here are some tips to help you get started:

🧌 Utilize digital transactions instead of cash or debit/credit cards

Many banks offer Unified Payments Interface (UPI), National Electronic Funds Transfer (NEFT), and Real Time Gross Settlement (RTGS), allowing you to transfer funds between different accounts easily.

🙂 Take advantage of the benefits offered by internet banking

With it, you can access all your account information at any time from anywhere—allowing better control over spending habits and helping manage expenses more efficiently than ever before!

🤑 Invest in recurring deposits and mutual funds through net-banking platforms

Platforms like Paytm Money and Zerodha Coin make investments easier while providing higher returns than traditional methods such as fixed deposits or savings accounts.

😏 Utilize mobile wallets for making regular payments

this eliminates the need for frequent withdrawals from ATMs, thus reducing bank charges associated with them and saving interest costs incurred due to credit card debts!

🙀 Opt for ePayment services like Bharat Bill Payment System (BBPS) & BHIM UPI

Users can pay utility bills like electricity, water, etc., without visiting each department separately or standing in long queues.

22. Utilize mobile apps for budgeting

Are you looking for ways to save money and keep track of your finances? If yes, then using budgeting mobile apps is the best way! Budgeting apps allow you to monitor your spending, set budgets and savings goals, stay on top of bills, invest smarter, and more. Here are some helpful tips when it comes to choosing a budgeting app that works for you:

⭐ Examine App Reviews

Before downloading an app, read reviews from other users. This will give you a better understanding as they provide insight into how well it works in practice.

🫰 Check Fees & Charges

Some free or inexpensive apps may charge hidden fees down the line, so check all charges associated with the app before committing. The same applies if opting for premium pricing plans like those offered by Mint or YNAB, which offer added features but also require upfront payments each month/year.

📱 Look at User Interface

Weigh out options based on the look and feel since this can drastically affect the user experience when utilizing an app; ask yourself whether menus are intuitively laid out such that navigation feels natural after only a few minutes of exploring the layout etc.

✅ In India, there are several great budgeting apps available, including Bajaj Finserv Wallet + Save (available through their website), which helps manage expenses while taking advantage of cash-back deals from local retailers plus Swiggy Money (from food delivery company), Zeta App & Paytm Money (both e-wallet solutions offering wallet management services). Last but not least is CRED Club—the financial rewards program backed by Mastercard—which provides solid tracking tools along with tangible incentives whenever one pays off credit card balance ahead of schedule 💸

23. Utilize government programs

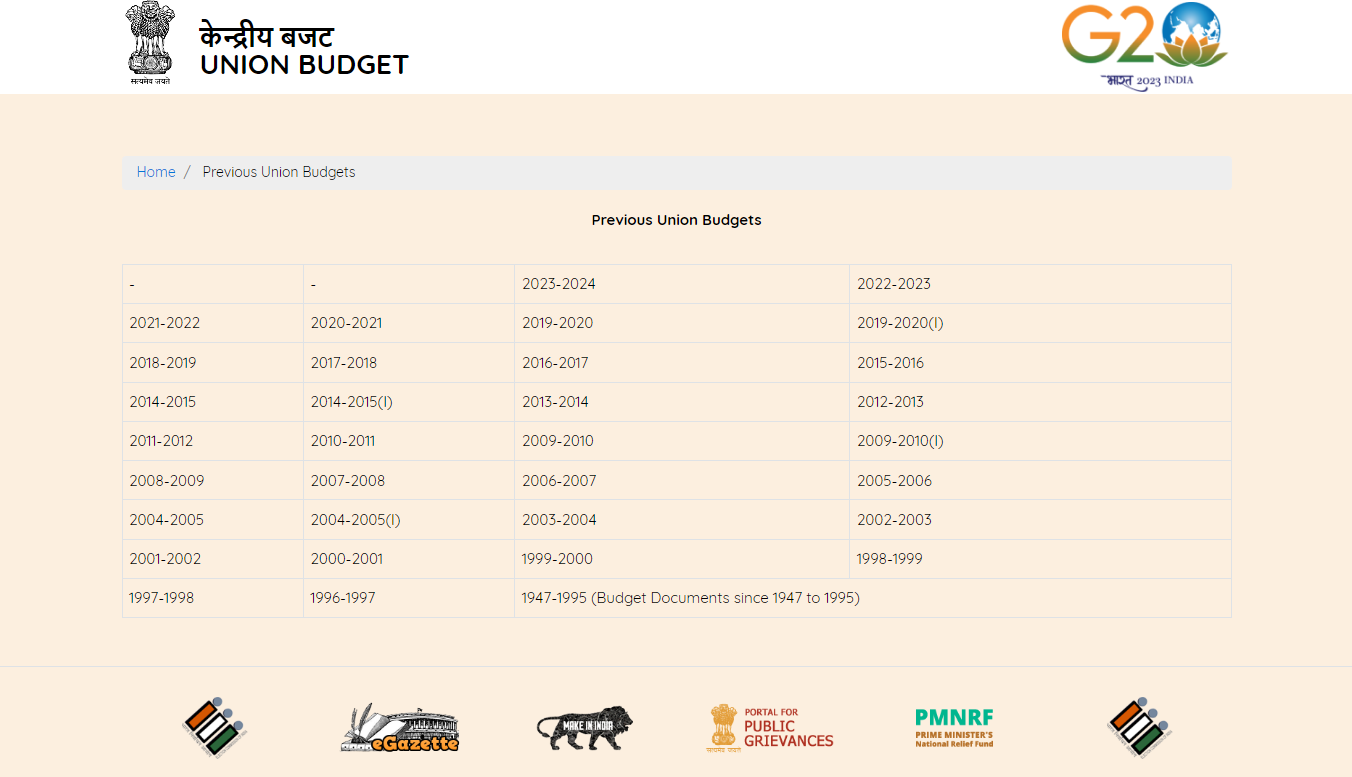

Saving money is an important part of creating a secure financial future. But it’s not always easy to do when you're on a tight budget. Fortunately, some government programs can help make saving easier and more manageable for Indian citizens. Here are some tips on how to save money by utilizing these government initiatives:

🤑 Utilize the Jan Dhan Yojana

The Jan Dhan Yojana (PMJDY) was launched in 2014 to provide access to basic banking services like savings accounts and remittance transfers at low or no cost for all citizens, especially those from economically weaker sections as rural households in India. Through this scheme, individuals get an account with zero balance, earning interest up to 4%. Opening such an account will enable you to save regularly while also earning little interest over time!

💰 Take Advantage Of Ujjwala Yojana

Ujjwala Yojana provides free cooking gas connections aiding millions of mainly rural women who suffer severe health consequences from exposure to smoke caused by traditional fuel sources used for cooking food indoors. Not only does this scheme improve air quality inside homes, but it also benefits people financially since they don't have to buy costly LPG cylinders anymore!

🧓Secure your future with Atal Pension Yojana

The government established this pension program to assist those working in unregulated industries, primarily private workers, in receiving a fixed retirement income.

This government investment scheme provides social security for the economically disadvantaged members of society by providing pensions in old age. The base amount of the pensionable sum is up to INR 5000.

The age range for applying is 18-40, and the person can contribute INR 42 to INR 210 monthly to receive a pension ranging from INR 1000 to INR 5000. The contribution period is limited to 20 years, with an exit age of 60.

In addition, in the event of death, the pension would be made accessible to the deceased's spouse, and any pension wealth acquired up to that point would be refunded to the nominee.

🥶Invest in the risk-free scheme with Public Provident Fund

The PPF risk-free scheme lets investors enjoy higher returns over 15 years at a variable interest rate of 7.1%. The investment amount ranges from INR 500 to INR 1.5 lakhs, with the maturity amount determined by the length of the investment.

This plan is applicable for 15 years and allows investors to save enough money on income taxes. The interest rate in this scheme changes every year, so keep an eye on it.

📱Invest in the post-office scheme available Pan India, the National Savings Scheme

This scheme, initiated by the government of India, is available at every post office in India, with some of the best and traditional government investment plans that come with high returns. It is packed with several positive features and is ideal for Indian investors, especially adults, and students.

It allows the program used to have a stable income and definite returns to generate the highest earnings, and this plan is now offered at a 6.8% annual interest rate.

- The minimum investment needed is INR 1000, with no maximum restriction at a 6.8% interest rate.

- The lock-in period is 5 years, and the tax savings are up to INR 1.5 lakhs under Income Tax Section 80C.

👧Create a savings plan with Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana is a savings plan developed specifically for the girl child in India. This initiative targets parents of girls and assists them in financially securing their daughters' futures by establishing a savings account in either a commercial bank or a post office.

This was started by the Indian government as part of the "Beti Bachao Beti Padhao" campaign and is offered at a 7.6% current interest rate. This scheme offers a greater tax deduction and coincides with EEE status.

Contributions to these accounts are tax deductible under Section 80C of the Income Tax Act. Once the deposited money matures and becomes non-taxable, it presents amazing tax benefits that cannot be overlooked.

🌱Another retirement scheme: National Pension Scheme

This defined retirement scheme for senior citizens guarantees a consistent income stream and assigns each policyholder a distinctive Permanent Retirement Account Number.

This plan has no maximum investment restriction, although funds can be invested in either stocks or government securities. The investment eligibility for tax deductions is as per Section 80CCD (1B) of the ITA, which is up to INR 50000.

🪙Invest in Sovereign Gold Bonds by the Reserve Bank of India

These gold bonds are issued by the RBI on the government's behalf and are basically government securities denominated in gold grams to assist investors in seeking an alternative way to buy physical gold.

The investor must pay the issue price in cash, and the securities are returned in cash after maturity at a fixed interest rate of 2.5% per year. They are given on the issue price, which is deposited to the investor's bank account in every six months.

SGBs are paper-based securities that also permit issuers for early withdrawal after the fifth year of the plan. Thus this means that there is no risk or storage expense.

24. Changing bank accounts come with perks

Switching banks is not an easy and instant feat to achieve. Still, it can help you save money by obtaining a better bargain, such as reduced interest rates on loans, greater interest rates on savings accounts, and additional merchandise and services.

😳Focus on where you can receive incentives

For new users, several banks provide sizable cash bonuses on withdrawals. If you're already thinking about transferring banks, there is a simple method to obtain easy benefits practically. These incentives are usually only available for a limited period, so act fast before it expires.

🦄Long-term benefits>>>>

This isn't an option you'd choose every time, but if you're looking for high-value offers or loans, you can do so, and because banks want new customers, for which they may offer you exceptional deals on various types of credit purchases. If you're moving banks, don't get too tied to the brief introductory offer; instead, look for long-term beneficial incentives.

🆓Sign-up customer offers!

Likewise, suppose you're looking for a new credit card. In that case, it may sound right to go for one with a higher sign-up bonus because you may probably have numerous cards in your pocket.

25. Apply the 30-day rule for purchases

Instead of buying on the spur of the moment, always wait 30 days before making a purchase. It means postponing all non-essential purchases for 30 days, allowing yourself plenty of time to consider if you really need to make the buy.

🫡Evaluate the requirement within 30 days

Start by identifying the product's critical and non-essential criteria. If it falls under the "wants" category, then only the rule applies, as you now have 30 days to determine whether you can live without it.

🏦Create a dedicated savings account for 30-day purchases

This way, you can ensure that you have the funds available after the 30 days and, more importantly, that the cash is not from debt or credit. If you don't spend it, you're rewarding yourself for all the impulsive purchases you avoid and end up saving a lot of money. Store the funds in a high-interest savings account for the best return on your investment and to increase its profitability.

💃Split your entertainment budget and set a challenge for yourself

This can help you distinguish between non-essential purchases and your typical aesthetic essentials, which should not be sacrificed and also must not fall into the category of impulsive spending. Make it a goal to save as much money as possible from your entertainment budget.

26. Best possible ways to host parties at cheap

Home cooking for gatherings is not cheap, but it is the most lovely gesture everyone values. On the other hand, those who arrange parties are well aware of how much even a little gathering may cost.

When we are on a budget, one of the first things we must reduce is entertainment, which also includes cutting out some of our socialization. Ok, so here are some wild suggestions for you!

🍻BYOB

Confused? That is known as "Bring Your Own Beverage." This is most likely the finest tip for hosting any type of gathering. We'll supply the meal, but bring your own alcohol (haha), and it'll be the most flawless idea to help you save money in a fashionable way.

🛍️Let’s pop some tags with only 20 Dollars in pocket!

If you don't want to borrow anything you don't have, search the thrift store first before you buy new, and whether it's extra seats or your new event attire, you'd be shocked at what you can thrift.

We recommend avoiding the larger chains and staying with local and non-profits because their pricing is typically better, and you can actually feel positive about the purchase.

🏠Decorate in a simple but elegant manner

We are not purchasing any pricey decorations. Write this on every visible portion of your body, then go shopping, and yes, no candles (please). If you have an upcoming event, plan a trip to Crawford Market in Mumbai or another similar location in your area to purchase products.

The curtain you purchased from "Homecentre" for INR 7,800 is the same available in Crawford for 700. Thus, when your friends ask where you got these lovely curtains, simply say, "Well, it's a gift from my cousin."

Furthermore, they are not one-time purchases; the curtain can be reused for numerous applications. Likewise, when purchasing a product, choose something that is multi-purpose rather than party-specific.

If you have a friend or family member who recently hosted a party and you liked a table banner or sheet, simply borrow it; if you are like (I don't want to ask or borrow it from that "woman"), simply wander the streets or visit "Manish Market."

🎚️Most importantly, never use a DJ

Why rent a DJ when you have Spotify in your pocket? I get that the advertising is bothersome, but the membership is 90 times less expensive than hiring a DJ or playing on YouTube, which requires you to have your screen on forever with no designated playlists.

If you don't have a speaker, you can borrow one from a friend or cousin or rent one. There are countless ways to save money by reducing small expenses, which are actually not small but divided into pieces.

Try hosting a party using the above method and let us know how it went and, more importantly, how much money you spent. As we go over more tips and tricks, we hope you can add some more to your party savings list, so keep reading!

27. Don't spend much entertaining your kids

Keeping your children entertained is not cheap. Before you spend a lot of money on game zones or other kid's activities, here are some amazing money-saving methods for everything from sports to fun activities.

⚒️Search for free trials, discounts, and new Kid Zone openings

Keep hunting for new opportunities and take your children to such places because they always provide cheap events when they start new. Look online for free courses, programs, and sites where you can receive group discounts and connect with other families to save money.

Check for additional options, such as refer-a-friend or other discounts on dedicated cards. Instead, you can simply organize a low-cost event like a children's party.

🏖️Organize a children's event

Simply employ a few college students with talents and teach them to teach the visiting kids things like clay modeling, painting, singing, music, sports, and so on. Bring your friends and their family over and blend learning with a play date.

This will help you leave an effective impact on other parents and children for those struggling with social connection in a new place. It will also help your children get to know other children their age and socialize in the new locality or even for those who have been there for ages.

28. Always negotiate the interest rates with your credit card company

Individuals who pay high-interest rates on credit cards should be aware that they have the right to negotiate their current interest rate with their credit card issuer and transfer the balance to a completely new card.

😊Approach the representative with politeness

Be kind and professional when dealing with credit-related issues; they will be more willing to assist you. Recognize that they have to deal with many such customers regularly and that some are unpleasant; being nice can only make them feel better.

This will also allow you to make some significant income, such as "why isn't every customer this courteous to me, thank you for being kind, and I'll help you with some hidden schemes." It's not like it happens every time, but the point here is that just be polite.

😇Inquire about a possible drop in interest rates using valid reasoning

It could be as simple as informing the issuer that you've been looking for credit cards and have discovered a lower rate than they currently offer. You can offer them an opportunity to meet or beat that rate to keep the card and avoid transferring your balance to another credit card provider.

🗣️Inform them of your objectives for obtaining a reduced interest rate

You may have recently improved your credit score or resolved to start paying off huge balances and would like some assistance. Here you may cite financial challenges such as unemployment or unexpected expenses that need you to carry a load on the card.

⛷️Perfect Pitch

If you have an excellent customer review, remind the issuer of your history, mentioning how long you have held the account here, how much you spend on your card annually and your history of on-time payments.

🪙Let them toss the coin

Allow the credit card company to suggest a figure first, which may be lower than what you had in mind, and if you are not pleased with the offer, you can suggest a lower rate.

🙄If you are dissatisfied, try negotiating again

If the given interest rate is insufficient, you can request a temporarily lower rate or other advantages. You can also inquire about extra points on reward programs or a waived annual payment.

Individuals requesting a break due to financial hardship may suggest a temporarily lower rate, such as to the card issuer, to replace your interest rate for a couple of months while you find work or for a year while you pay off your medical bills.

If you are not satisfied in any manner, simply ask them to reconnect you to the manager or call again to try your luck with a different agent. If none works, change your bank since we have already discussed the benefits above.

If you receive a lower rate that is also satisfactory, request a confirmation, read carefully the fine print, and check your next invoice for proof that the change has been made and you are being charged a lower rate.

29. You might not believe this, but drinking water can also help you save money 💧

Drinking plenty of water has numerous health benefits, which we all know already, but it also helps us save money, which is a crazy concept for many. Drink a large glass of water before each meal; you will feel more full for a long time and ultimately eat less.

This will allow you to save money on any food or snacks you may purchase during that period. The central problem here is that your stomach is full, your body is dehydrated, and your pocket stays untouched.

Most recommended time: Before going Shopping!

30. Transition your library with Smart Devices

Bookworms adore collecting books that they read and storing them as precious teaching and memories in their personal library. But, when it comes to saving money, buying books is not a good idea because it takes up space, time, energy, and money.

📲Download Online

Various official websites provide free eBooks and audiobooks, with a selection of over 50000 official books. We do not suggest pirated websites because they may result in data leakage.

🧾A virtual book can be borrowed

You can borrow eBooks, audiobooks, and comics from the Internet Archive's massive collection for up to 14 days. If you register with OpenLibrary.org and install the encrypted file with multiple titles published on its website, you can also share it with your friends.

🏫If not online, go to the library

There are various libraries, such as "The Asiatic Library," where you can read a book and find the mental serenity you want. Every library provides a designated area for users to read quietly and occasionally take a book home.

The library is unquestionably the best option if you want to read books while saving money and do not want to use virtual eBooks. It also allows you to socialize and learn more from other readers.

Membership cards are considerably less than buying the book, and there are 263 government libraries and 4534 grant-in-aid libraries in India, so take advantage of them.

31. Unsubscribe unnecessary memberships

There are often savings to be gained by committing to a product instead of purchasing it each time we need it; this is most common when subscribing for a membership, and we no longer want or need a specific application.

There are three methods for identifying unneeded subscriptions and stopping spending or wasting money on these sites, which can lead you to discover how to save money in the first place.

🤖Keep an audit

Procure and collect your most current bank and credit card statements, and review the overall costs, expenditures, and subscriptions you pay for. If you observe frequent payment, check to see if there is regular usage.

If there is no consistent usage, simply cancel the subscription and shut down the site. This will allow you to simply distinguish your auto-renew payments from card payments and save you a lot of money.

Sometimes, even if we have the application installed or not, we forget to unsubscribe from it, and the money continues to be deducted monthly or yearly without our knowledge.

📃Make a subscription list

Input the cost of your memberships and subscriptions, and note all the names in the list so you can keep track of everything. This will also assist you in identifying renewal dates and keeping you current to prevent notice periods or expiration.

🧐Determine your demand

Now that you've compiled your list, it's time to cancel and discontinue the undesired subscription. Simply go to the dedicated website and cancel your subscription. If you are a lone user, choose individual packs rather than family or group.

This will also help you save money even if you do not utilize it. Sacrifice a device; it's alright, but you'll save far more than you think. The amount may appear modest, but it quickly adds up if you check it annually.

32. Stop going to Malls

The mall can be a fun place for most people, but it is also full of temptation, so you should avoid going there unless you need to buy something. If you simply go to the mall for some time, you will undoubtedly leave with at least one pink note burning.

🚰Before going to the mall, drink some water

As previously stated, water keeps you hydrated. Drink at least five glasses of water when you get to the market or mall to help you make some smart decisions and keep your stomach full.

If this seems absurd, trust the psychologists; they will always recommend water or nuts as an alternative to satisfy your stomach for at least a short while.

👠Women, wear high heels when you go to the mall

You're probably wondering why. High heels lead to better purchasing judgments because the effort necessary to keep the balance creates a moderative on spending when it starts to pain after a long walk in the mall, so you just hurry back home.

🎧Myth or Fact: Avoid stores in malls that cater to your musical tastes

Numerous studies over the years have shown that having quiet music playing in the background or something comparable to your taste or preference, such as popular music, causes customers to spend more time in the store and is more likely to make a purchase.

33. Going paperless could help you save major

Consider this: which is more pleasant and accessible: locating a paper document, reading it, and then mailing or storing it back, or clicking CTRL+F on your system and locating the files and then storing it back in your device? Of course, the digital.

💸Stop storing receipts and invoices on paper and start collecting them online

Ordering a pizza or simply a meal and obtaining an invoice for it is the same; you get a printed receipt that is a nuisance to the store because all it does is weigh down your pocket or wallet.

Instead, just ask them to send your bills online, which they usually do now, and stop stuffing your cabinet with unneeded bills. Even if you do, be sure to clean it every time. This will save you energy, time, space, and money.

💤Paperless security equals Z++ security

There have been numerous tales of hacking, scams, and data breaches, but all of these occur when you click needless links or fall into their trap. Thus, hackers pass through your gate in a way, but everything remains safe if you maintain it guarded.

Password-protected encrypted files will allow you to store the bulk of your data rather than 10000000+ in your drive or cloud storage, saving you the majority of the costs associated with creating a storage facility, investing in paper, ink, etc. printing supplies, or writing materials.

34. Save money working from home

It's not that every company allows employees to work from home, but if the possibility exists, take advantage of it because it will save you a lot of time, energy, and, most importantly, money. Let us explore!

You can always ask your company to cover "reasonable" costs that are explicitly essential for your job, such as desks, seats, and technology. You can also claim tax breaks as an exemption even if you only work from home one day per year.

That being said, let's look at some of the additional advantages of working from home!

🚉You save major savings by eliminating commuting

Getting up early, taking a train with a loaded rush, and reaching your office, which in the complete process includes a cab, train, bus, auto, and even occasionally a bike, can be pricey no matter how far or close your office might be.

You are saving money on petrol, automobile maintenance, travel passes, and other expenses that you can invest or store in your fixed deposit or RD. If your firm offers pick-and-drop solutions and you work from home, you may be able to get your travel allowance.

👷No more formal or other professional attire restrictions

We embrace minimalism and have adopted it as a style when we travel. Still, at home, we frequently audit our existing clothes to see what suits us and typically wear anything, even on an average business day from home.

This helps you save a lot of money because most of your spending is on clothing, and some people spend so much on clothing that they forget about their necessities.

🏛 Make sure to do tax breaks

As previously stated, if you are a full-time employee or a freelancer, you may be able to "write off" components of your professional charges, such as phone bills, internet services, and other office expenses, in addition to the ones listed above.

Working from home has various advantages. You save money on commuting, and, more importantly, you are qualified to obtain the bulk of the tax and other costs associated with your office routine, so make sure to track it down and obtain every ounce of your salary.

35. Better switch on debit cards and eliminate credit card

Why? To avoid overspending. Simple. When we use a debit card, we merely utilize the money we now have and live on whatever is left over. In contrast, when we use a credit card, we incur debt and lose the limit on transactions as we simply "swipe."

When we use a debit card, our purchases appear quickly in our bank account transactions, and our account balance will drop by however much we spend. On the online bank account section, each debit card purchase is listed in the withdrawals, deposits, and also checks we have issued.

When you use a credit card, all you do is increase your debt, and since you'll be paying for this one later, why not use it another time and simply increase the amount and repent later?

36. Do It Yourself

Let's go to DIY, no? Let's DIY, which stands for do it yourself, and these are great for various reasons. The first benefit is that you receive the gratification of doing something independently using your hands and skills. Second, it is entertaining, and third, it is rewarding and joyful.

🪡Sew it Yourself

Everyone should be familiar with the old needle and thread and be able to patch their personal garments to save money while adding life to their favorite shirts, jeans, and other apparel, even bed sheets.

Sewing is not an expensive charge which you can simply do so in mere funds, but while you are in budget save mode, try doing this yourself as it will also invest your time and brain.

🎨Paint it Yourself

Painting vast areas can feel more like a chore than a skill, but doing your own painting saves time and money and is also a relaxing therapy. That takes work, to be sure, but you must evaluate whether the time and effort exceed the possible savings.

When you paint your house or a wall hanging yourself and are satisfied with the results, you get that gratifying sensation, and it is also a fun activity whether you live alone or with your family, but more importantly, you save a lot of money you were supposed to pay to the labor.

🛅Lock it Yourself

You don't need a locksmith to change your locks because you can do it yourself and save money. All you have to do is watch some tutorials or DIY on YouTube and do the following, but make sure you are not invalidating your property insurance in any way.

Locksmiths may charge you hefty sometimes for only rotating some of the chores and describing a major problem, so simply hop on Youtube and check DIY videos for changing locks, etc.

🧑🔧Plumb it Yourself

Hiring a plumber is rarely a cheap activity, and there are many things that you should leave to a professional. Still, plumbing is one of the few that amateurs can successfully undertake on their own, and it is also a basic skill that you can acquire from YouTube or your father or mother.

💅Maintain it Yourself

Your vehicle may require a lot of regularly scheduled maintenance. You can drastically reduce the prices by executing some of the jobs on your own, and for that, always jump on YouTube or simply check what the technician does once and duplicate yourself the next such as oiling, engine checks, changing tires, gear checks, wire checks, greasing brakes, etc.

🔁Repair it Yourself

Having a home is the nicest feeling in the world, but it comes with a lot of obligations to keep it in good condition or at least presentable and efficient. When problems arise, employing a handyman is not the solution; saving money by learning to repair products, appliances, and doors yourself is also doable.

🧼Clean it Yourself

Hygiene maintenance and product costs are usually high, so instead of investing large sums in hygiene products, make your own cleaning products where you can also swap the often-harsh toxins with more natural ingredients, which is convenient and may help you prevent certain allergies.

🪴Grow it Yourself

Many people enjoy gardening because it is peaceful and has some meditative properties. Still, you can save money on groceries by cultivating food plants instead of useless plants.

💇♀️Cut it Yourself

If you have a large family, regular trips to the salon will start adding up, even for shaving, so start cutting costs by purchasing some scissors and trimmers and learning to cut your own hair, which can be difficult at first but you can try this method as it helps save a lot of money.

🐕🦺Groom it Yourself

If you have pets, the cost of total pet care, including breeding and grooming, might sometimes be prohibitively expensive. If your pet is young, try getting them acquainted and comfortable with the grooming procedure on your own, making the experience more enjoyable for both of you.

Understand that all of the DIY activities described above, or may have overlooked others, are simple and feasible tasks for both men and women and are basic skills that everyone should learn regardless of their purpose.

37. Stay current with the sales

It is always a good idea to go shopping and find your favorite product at a discounted price since it makes us thrilled, and we plan to buy it right away to prevent missing out on the opportunity to lose the product. Here, we also save money and acquire better yet satisfactory items.

Saving more money is a significant benefit that anyone can obtain when they purchase any product on sale, whether online or offline. Different percentages of discounts are available during the sale ranging from 5% to 50%, which are attractive percentages.

The money saved is money earned and may be used for other purposes, and the points below provide an extra concept for saving more wisely, which is why we propose you wait before making any purchases, as in for a sale or discount.

🛒Always shop around for the best deal

The discounts offer allows you to compare prices and discover the best price for a specific product, saving you a lot of money. If you can't find a decent deal, you can always discover another shop or store and pitch other dealers with the discounted price you were obtaining and try to earn an additional discount.

🎫Purchase discounted gift cards

Discounts or gift cards can be acquired at a reduced cost and given to friends, cousins, and family members to help them save money and be redeemed by you (haha).

38. Why pay for tuition when you can learn online for free?

Tuitions and education, in general, are prohibitively expensive in India. While we cannot eliminate school and college, we can allow our children to study from free classes or YouTube sessions, or e-Learning courses that have the same manner, learning, etc.

Reducing tuition fees will at least provide some relief from the enormous burden of school fees and other activities. E-learning is the same as traditional learning but far superior to traditional tuition.

💻E-Learning can also be free

A typical classroom-based course includes several fees in the total tuition fee. There are trainer fees, venue fees, paperwork fees for the provider, travel fees, and additional taxes for the participant.

🎙️E-learning is versatile

Instructors can start a lecture from their house, hotel, garden, or even a co-working space at their independent space with flexibility at the forefront, and students can attend the lecture from their home on a family holiday to not miss a class, so on, saving the bulk of your money.

How? Because you are not paying and it's a free class, and even if you are paying, the expenses are not as large as physical tuition fees with additional costs and unwanted taxes, you are certainly eliminating studying from home.

👨💻E-learning can be more focused

Rather than participating in a class with several other students, e-learning can indeed be your platform (introverts) because it is personalized to you and your learning needs, measuring your performance and allowing you to decide the speed of the lecture.

Concentrate on the crucial categories you need to learn and swiftly complete areas of competence under the supervision of an expert and with autonomy.

39. Always sign-up for annual subscriptions

Annual memberships provide significant discounts over monthly bundles on various sites. It also enhances financial management because the payment is made in one lump sum and can be adjusted according to the good financial month.

We save money over monthly or quarterly plans when we pay for the year in advance. You might simply discover the difference by calculating the monthly pack on an annual basis and comparing the actual annual plan pricing.

It also comes with only one invoice per year, making it simple to monitor bills and spending. Implementing costs are significantly lower if you use a payment system that charges per transaction.

Now that you have compared it to the monthly plan and totaled expenditures, you know that paying monthly will probably be more expensive than buying the annual plan altogether.

40. Never opt for other ATM withdrawals

When we withdraw cash from an ATM, we inevitably have to pay a fee to the bank and the ATM operator's fee, which adds up a little sum to the total amount of our withdrawal. There are methods to avoid paying ATM costs, such as utilizing your bank's ATM, finding an ATM partner, or opening an account that reimburses ATM fees.

🏧Use only your bank's ATM

Your bank will always enable you to use their ATM services for free, and it is more convenient and safe to use your bank's ATM rather than another bank's. You may not always have a choice, but in such circumstances, bear with the extra charges.

📶Opt for in-network ATMs

Simply go to your bank's website and see whether your bank has collaborated with other banks or institutions to provide you with access to more free ATMs. Your bank may also be a member of a major ATM network, allowing you to withdraw cash for free from any of these machines.

🫰Pay your bills online and save free transactions

Save all free withdrawal transactions for requests such as balance inquiries, mini statements, and so forth using mobile banking. Additionally, consider paying your bills online occasionally instead of directly from your bank account. You may also get some rewards and discounts online.

🗂️Don’t have cash? Swipe your card instead

You can easily limit the number of times you need to withdraw money by swiping your cards rather than withdrawing money from the ATM, and several merchants now use card readers, saving you the trouble of looking for an ATM.

41. Get down and first create a fixed deposit

Fixed deposit schemes are considered one of the safest investment alternatives because you invest a lump sum amount for a certain period. The tenure and capital amount invested determine the interest rate applied to your FD.

🈂️FDs allow you to save money over time

It does not include the opportunity to withdraw money without penalty, but it may prevent you from withdrawing money before maturity, which can be up to 7 to 10 years.

🧩You can get a greater interest rate on your FD

FDs provide higher interest than savings accounts, and you can also borrow against your fixed deposit and obtain a credit card against your FD, with a maximum limit of 90% of the amount in the FD.

The interest income produced on FD is exempt from TDS up to a maximum of INR 40,000 in one year, and if you participate in a tax-saving FD, you receive a tax rebate as per section 80C of the IT Act.

42. Instead of heading to stores, buy furniture from manufacturers

Yep, you read that correctly, and if you're stuck and want to evaluate your options, here's all you need to know about buying furniture directly from the manufacturer.

🛏️The price difference is easily discernible (haha)

One of the key reasons why many of us purchase furniture from manufacturers directly is that we pay higher prices when we buy it from retailers since the retailer incorporates additional fees in the product's final costs.

Thus you're paying not just for the furniture but also the retailer's markup taxes, display, and profit margins.

🛋️More options for customization

We are not compelled to settle for cookie-cutter solutions when we buy directly from manufacturers, as retailers often stock up on prefabricated furniture that has been produced for the masses, whereas buying directly from manufacturers allows you to tailor your order any way you like.

🪑A larger inventory catalog

Retailers and third-party vendors select pieces of furniture they believe their consumers would enjoy and cater to a specific audience, rarely retaining unique pieces. Some only sell modern furniture, while others sell mid-century and classic furniture.

But what if you want to bring historic patterns and modern trends into your home? You will seldom find such pieces in a third-party store or retailer, but a manufacturer may rapidly give you what you need without even paying any exorbitant unwanted charges.

43. Buy seasonal clothes off-season: Winter Wear in Summer

Don't get me wrong or put me in the weird category, but this strategy works. Winter wardrobe preparation can be costly, but there are methods to prepare for the cold season without breaking the bank.

The best time to purchase for winterwear is in the summer when you can acquire it for nearly half the price. To help you make smarter decisions, here are some reasons why you should buy winterwear garments in the summer and vice versa.

☀️Nobody wants to buy winter gear in the summer

The conventional retail approach is to hold baggy and bulky clothes away for the average price because it is off-season. You might find them in the winter for an expensive rate with additional costs (that same product). As a result, buying clothes in the summer is almost like getting a bargain.

Not only are there clearance products from previous seasons, but clothing retailers may also exhibit some good pieces on sale during the off-season. Buying your snug sweaters and warm textiles early means you get everything at an inexpensive price before it soars.

🔅You also get hands-on experience with a versatile collection

Winter clothing has a lot of adaptability because some pieces can be worn all year, so stocking your winter closet in the summer is a good idea because you won't have to wait until you can test your new items.

Unlike in the summer, when you only have a limited period to embrace your beach style since summer items cannot be mixed and matched, winter apparel can be mixed and matched and is better suited for every occasion.

🔆Buying winter clothes in the summer is always a better deal

Because winter clothes are more versatile, you wear them in various ways. Buying winter wear in the summer allows you even more time to wear your new outfits, and the more you wear them, the greater value the clothes will be, guaranteeing that your money is well spent.

Okay, now that we've covered all of the tips and tactics, let's look at the necessity of saving to better know the good parts of the "tomorrow" we've all been waiting for.

Why doing savings important?

Saving money is one of the most important aspects of achieving financial stability and having a secure financial future, which also provides you with an exit strategy from numerous life vulnerabilities and the opportunity to live a great life.

As previously stated, when you save money, you store a good amount of income in case of crises or any abrupt instances where you may require a heavy wallet.

Putting aside a certain amount of money can help you navigate various challenges and roadblocks in your daily life and support you in your hour of need. Before we go into how to save money in India, let's talk about why you should save money in the first place.

🆘Unpredictable Emergencies

A crisis or any other type of emergency never comes when we expect it, and it always comes unexpectedly, leaving us with no time to think or react. Having money saved, even a small amount, provides you peace of mind that you have a backup.