Table of contents

An alleged wallet address received money from numerous US and international wallets connected to FTX (1), which gathered over 83,878.63 ETH (2) in under two hours. the recent disputes between the two biggest cryptocurrency exchanges, FTX and Binance, were accompanied by a significant decline in the value of FTX Tokens.

Due to this collapse, a total of 130 businesses were connected to the FTX Group, including FTX Trading, FTX US (3), West Realm Shires Services, and Alameda Research.

While Sam Bankman-Fried (4), the CEO of FTX, resigned and the company's chapter 11 bankruptcy was made public, on-chain data suggested that the bankruptcy process had already begun because numerous FTX wallets had been seen sending money to a single Ethereum wallet address.

With all eyes on FTX, the late-night fund transfers raised several concerns about the company's intentions. The wallet address was also in doubt for receiving funds from various international and US-based wallets linked to FTX that amassed over 83,878.63 ETH in two hours and continued the influx of funds.

Some blockchain investigators also interpreted it as the start of the bankruptcy process by making assumptions about the overall malice and an external hack that surfaced across the crypto ecosystem. While approving USDP, a Paxos-issued stablecoin, for trading on the CoW protocol (5), the wallet owner was discovered switching $26 million of Tether USDT to DAI via 1INCLH.

The wallet also permitted the sales and transfers of other cryptocurrencies, such as Chainlink LINK, cUSDT, and stETH (6), if the scenario developed. Later, the funds from the FTX wallets were transferred to new addresses, one of which was pointed out by blockchain investigator PeckShield and identified as the FTX on Etherscan.

An investigation revealed that 8,000 ETH had been transferred from Solana to one of the new addresses within the previous hour. According to the investigation, a hacker's involvement is unlikely because they would have transferred the money from FTX's wallet to their wallets.

Even though several users and supporters raised the potential involvement of an insider, the community is still keeping an eye on the flow of funds while the situation is still in flux. However, as FTX has not yet replied to any comments, investors have been strongly advised not to speculate until confirmed reports are in place.

The unconfirmed report also suggests that SBF moved $10 billion in funds to Alameda Research while also pointing out that the missing funds' whereabouts are unknown. FTX sources told Reuters that between $1 billion and $2 billion of the client's funds are unaccounted for in the company's spreadsheet.

Major crypto exchanges like Binance, OKX, Kucoin, and Crypto.com shared their proof of reserve to win back investor confidence. Still, the collapse of Terra Luna and FTX, two major crypto ecosystems, highlighted how crucial it is to be transparent about the real reserves held by crypto exchanges and businesses (7).

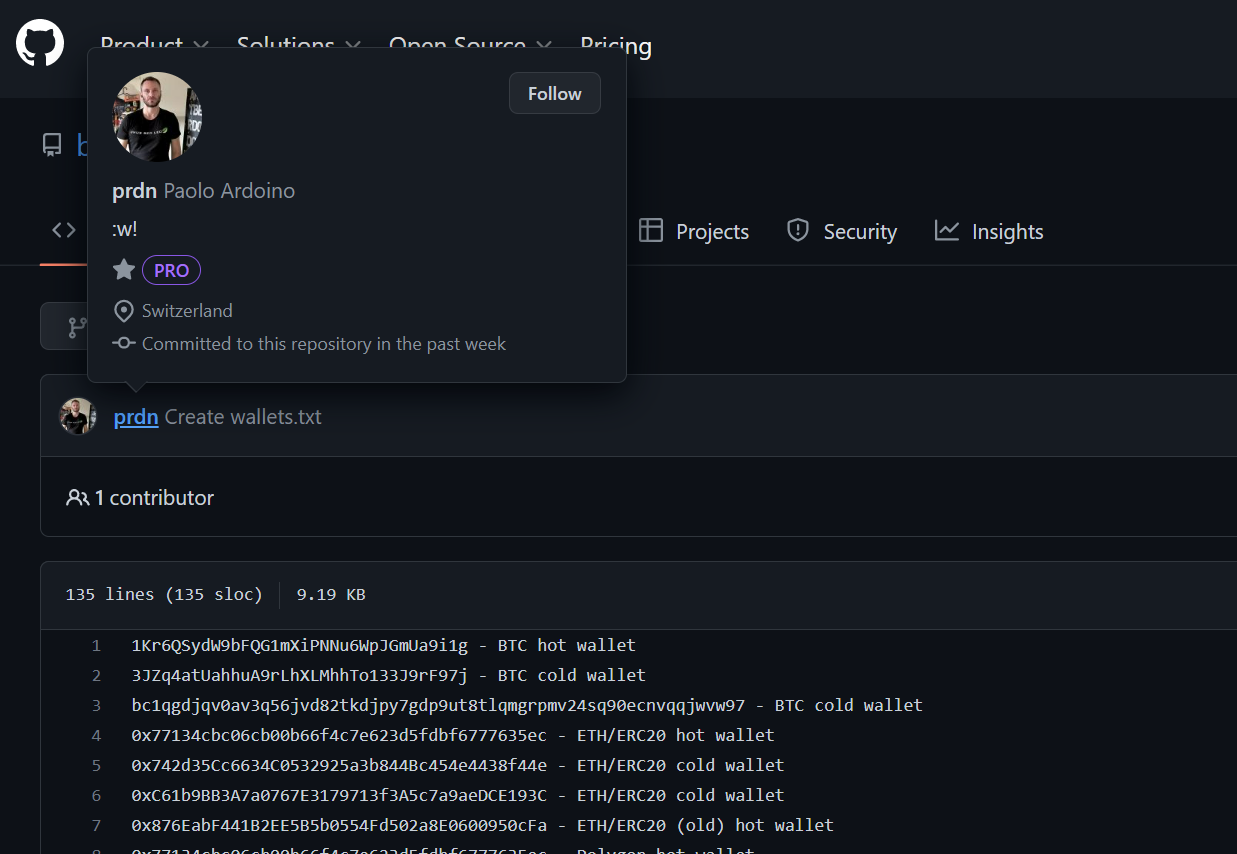

The crypto exchange BitFinex (8) disclosed its proof of reserves to the public as its CTO Paolo Adronio shared the list of the key Bitfinex wallets, erasing the uncertainty and doubt caused by FUD throughout the cryptocurrency space.

Ardoino shared Bitfinex's proof of reserves on GitHub, listing a total of 135 cold and hot wallet addresses to save users the trouble of going through the addresses he listed. Among the top holders of the company's significant holdings were massive amounts of BTC and ETH (9).

In 2018, Bitfinex created the Antani open-source library to promote transparency concerning evidence of solvency, custody, and off-chain delegated proof of vote. Although it had previously gone unnoticed, Ardoino later confirmed Bitfinex's plans to revive the system and let users check their balances without jeopardizing their privacy.

According to Antani's whitepaper (10), users can cryptographically verify their balance, enabling Bitfinex users to validate their ownership of the assets and eliminate de-pegging threats. Although the community welcomed the discovery, others pointed out that it was incomplete because it did not include Bitfinex's liability figures.

The FTX incident caused significant outflows from cryptocurrency exchanges, and hardware-based cryptocurrency wallet provider Ledger had a brief server outage. Ledger security and self-sovereignty solutions experienced a significant outflow from exchanges following the FTX earthquake, which was explained by the company's CTO, Charles Guillemet (11), even though he noted that the system quickly resumed operation.

While Elon Musk just acquired Twitter to realize the platform's potential fully, he also recognized its use in following the FTX developments in real time. Numerous wallet addresses connected to FTX were discovered moving millions of dollars worth of cryptocurrency on November 11 without official notice, leading to rumors about everything from the start of FTX's bankruptcy proceedings to hacker participation.

Tether (12) aggressively blocked USDT tokens worth $31.4 million associated with the transactions after FTX acknowledged on Telegram that the fund transfers were a part of an ongoing hack within hours of the confirmation. The $27.5 million USDT on Solana (13) and the $3.9 million USDT on Avalanche AVAX made up the blacklisted USDT tokens.

Elon Musk also recognized Twitter's potential to assist in the real-time monitoring of FTX developments. At the same time, the blacklisting of the purportedly stolen USDT token prevented hackers from transferring the funds to another account or swapping them for other cryptocurrencies.

The banned USDT can also be burned as part of this remediation, and the original owner will receive equal amounts of the assets again. However, in addition to these, the hacker also took many other crypto assets, including USDP, Chainlink, and Ethereum, which have not yet responded from their respective ecosystems.

Recap: In the last few days, cryptocurrency exchanges committed to publicly disclosing their proof of reserves to restore investors' trust. Paolo Ardoino, the CTO of Bitfinex, took the initiative by sharing 135 cold and hot wallet addresses and revealing the company's proof of reserves.

Despite the positive reaction from investors, a small number of community members brought up the incomplete data and lack of liability figures. FTX has left a lasting impression on the industry as to why transparency is crucial, which will serve as a lesson for many.